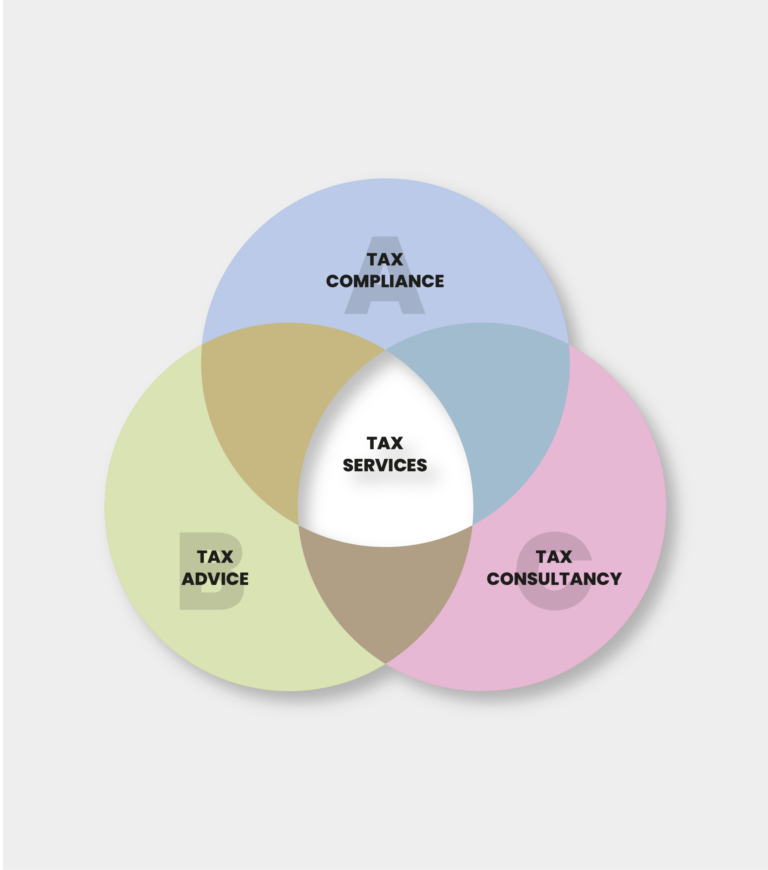

Three types of Tax Service

We’ve devised a way to define our tax services to make them completely transparent and clear for our customers, and us too! Our Tax Services are broken down into three areas:

Tax compliance

Helping you pay the right amount of tax that’s due; your year-end accounts and tax return.

Tax advice

Delivery of specific work or planning to improve your tax position, to make a future saving, or get cash back into your business e.g. making an R&D Tax Claim

Tax consultancy

Reviewing your overall affairs & motives and applying tax legislation to their situation, to see where you may benefit from advice in the future.

Most accountants will have a tax compliance service that is priced or built into their accountancy package services; with tax advice delivered and charged for as and when a situation arises.

Tax consultancy though? This is a bit of an unknown. But it’s where the most value sits for you as a business owner. Find out more about our tax consultancy services below.

Our Tax Services

At Adams O’Rourke Accountants, we aim to be completely transparent with our pricing and recognise that as with accountancy services, the individual tax requirements of a business are very different.

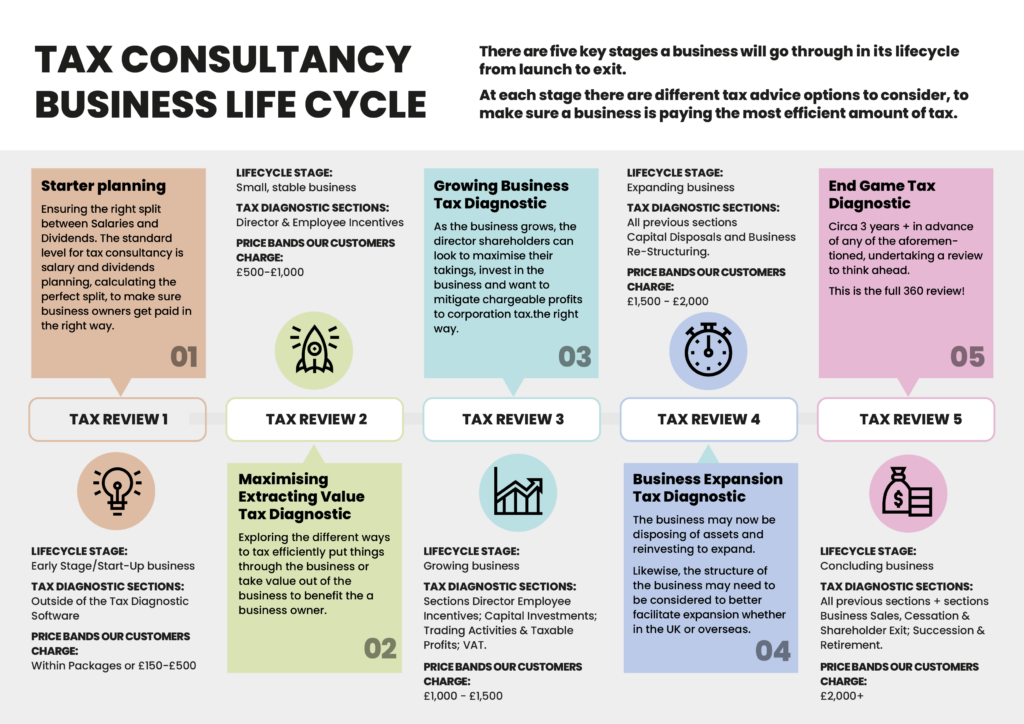

At each stage of a business’ lifecycle, there are different tax service options to consider, to make sure you are paying the most efficient amount of tax.

As a result, we have five different tax diagnostic reviews available to choose from. The fees for our tax diagnostic review services are set out below

What Is a Tax Diagnostic Review?

Until recently, there has been no universal system for, reviewing your overall affairs and motives, and applying tax legislation to your situation, to see where you may benefit from advice retrospectively, presently and in the future.

That’s why we’ve invested in market leading technology to enable us to deliver a tax diagnostic review service that is not widely available to business owners.

In a tax diagnostic review service we will identify all the: tax advice needs, tax saving opportunities, allowances, incentives and reliefs, applicable to your business. The review covers all the relevant areas of tax, whilst applying your personal, business and financial situation. These are things that relate to you, your family, your life, your business. Make sure you’re doing them as tax efficiently as possible.

Depending on where your business is in it’s lifecycle, there are different tax diagnostic reviews.

What’s Included

As part of our tax diagnostic review service we will:

- Complete a full analysis to identify all the tax advice needs, tax saving opportunities, allowances, incentives and reliefs, applicable to your business.

- Produce a detailed report outlining all the tax advice needs, tax saving opportunities, allowances, incentives and reliefs, applicable to your business.

- Produce an action plan outlining the priority areas to focus on, including estimated tax savings and quotes for the delivery of recommended tax advice.

What To Expect

If you’re ready to go ahead with your tax diagnostic review, here’s what to expect:

STEP 1: Discovery Stage

We’ll gather the key information required about you and your business, in order to complete Step 2 the Tax Diagnostic Review.

STEP 2: Tax Diagnostic Review

We’ll run a Tax Diagnostic Review on you and your business, and analyse the findings, ready to share the results with you via the 45-min ‘Impact Meeting’.

STEP 3: Impact Meeting

We’ll invite you to a 45-min ‘Impact meeting’ where we will take you through the Tax Diagnostic results. We will explore three priority areas, explaining why it is relevant, the benefits and the tax savings.

You’ll take away an action plan outlining the priority areas to focus on, including estimated tax savings and quotes for the delivery of recommended tax advice.

Take Forward the Advice!

We’ll take forward any immediate any tax advice, and work with you to deliver your action plan.

Tax Advice

At the end of your tax diagnostic review service, tax advice will be identified to improve your tax position, to make a future saving, or to get cash back into your business.

Where tax advice is identified, we will provide calculated tax savings, a proposal of work and a quote for the delivery.

All tax advice will be quoted for separate from the tax diagnostic review fee.

Book a Tax Diagnostic Review, Just Right for You!

The likelihood is, you’re not currently maximising all the tax saving opportunities available to you – and you could be missing out. Book your tax diagnostic review, get full control and peace of mind you’re doing everything you could be.